IHG Hotels & Resorts revealed on Tuesday that it has been pitching hotel owners on a new brand addressing an opportunity in the middle of the market it said is underserved.

“Our aim is that this new conversion brand will become the first choice for guests and owners in the midscale segment, accelerating our growth in a space that is already worth $14 billion in the U.S. market alone,” said CEO Elie Maalouf during remarks tied to the company’s quarterly earnings.

The Windsor, UK-based hotel group — whose brands include Holiday Inn, Crowne Plaza, and Six Senses — didn’t reveal the name of the new brand, which has become IHG’s 19th brand, or other details.

“We’re delighted that more than 100 hotels have already expressed definitive interest in the new brand,” Maalouf said.

Designed for Fast Growth

Maalouf likely wanted to prioritize a conversion brand over a new construction brand to help address IHG’s need to maintain steady growth in its hotel pipeline.

Unlike new-build brands that take time to grow because of construction delays, conversion brands can expand quickly, especially as many independent hotel operators or owners of properties flagged with older brands seek a refresh.

“Conversions represent a major growth opportunity for us, generating around 40% of first-half openings and signings globally,” Maalouf said.

Addressing the Mid-Market

The new brand is Maalouf’s first big move as CEO, having taken the top job last month.

Maalouf had previously led the group’s North American business for 8 years. During that time, he showed an interest in mid-market growth.

Maalouf led his team in debuting the new brand Avid, in 2017, which he said at the time targeted “a vastly underserved $20 billion segment of the U.S. midscale market.” Avid charges roughly $10 to $15 a night less than Holiday Inn Express, IHG’s midscale leader, and less than Candlewood Suites, IHG’s other mid-scale brand. (The difference in market size figures Maalouf has quoted refers to different segments of the overall mid-market.)

Given Maalouf’s sense that the mid-market is underserved, he has prioritized putting another IHG brand on the grid. That said, IHG’s board (on which he’s been a member for years) approved of this initiative before Maalouf became group CEO.

The hotel franchisor already has upper midscale with Holiday Inn and Holiday Inn Express, so the new brand is likely more affordable.

IHG expects to target around a 25% lower cost per room to convert to the new brand than that for Holiday Inn Express.

Facing Rivals

IHG’s rivals have also been looking at the middle of the market.

- In June, Marriott International said it would expand into the “affordable midscale” hotel category in North America with a new hotel brand — which it hasn’t yet named. The move came after earlier this year, when it completed its acquisition of City Express, a midscale brand focused on Latin America.

- Hilton CEO Christopher Nassetta said in his second-quarter earnings call that the “mid-market” was what he coveted long-term. “We’re not ashamed of saying we have every intention to have the best brands in every market to serve the mid-market because we think that’s where the most money will be made over the next ten or 20 or 30 years,” Nassetta said.

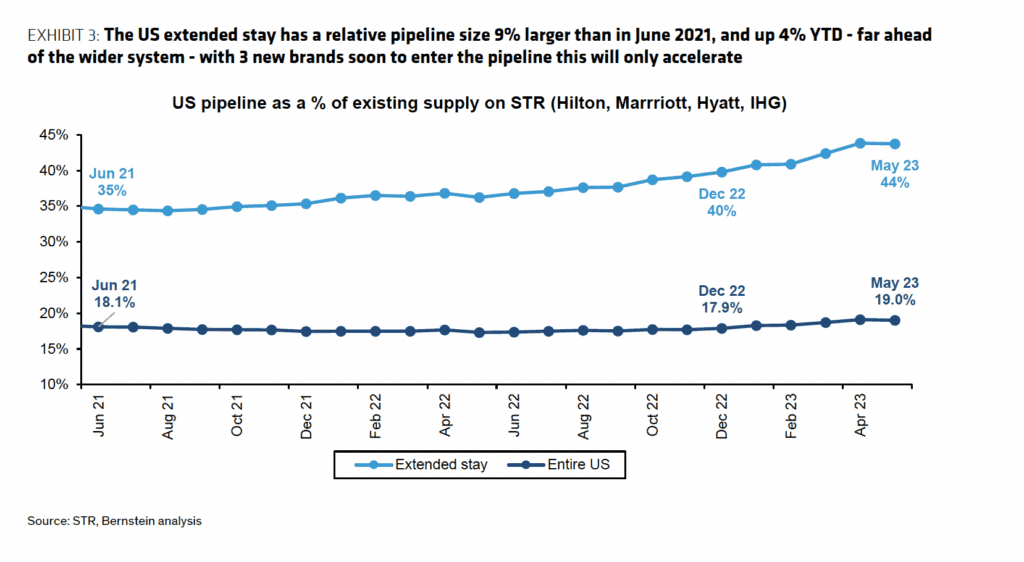

- In May, Hyatt unveiled a new brand, Hyatt Studios, in the upper-midscale segment.